In many parts of the world, power generating capacity is under strain. This means large industry players such as foundries and mines are often forced to cut back on usage to maintain grid stability.

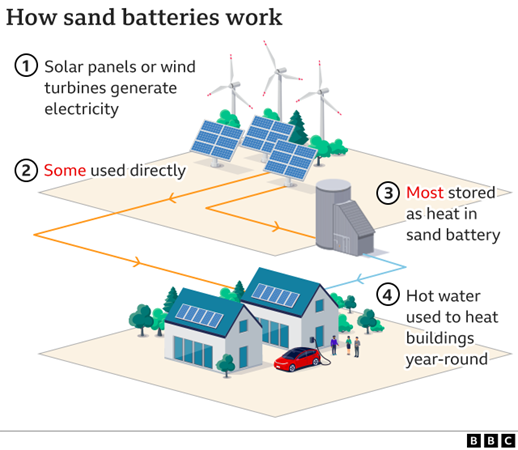

However, using solar power and fast-acting battery storage to operate independently of the grid offers a way around such restrictions. Such a combination addresses the often large and dynamic load changes industrial users require during operations.

We will discuss solar-hybrid options in a future article. Today we focus on how solar’s trajectory has been affected by the global COVID-19 pandemic, the implications for present and future solar development projects, and how to potentially mitigate those challenges.

Before we begin, solar power’s key advantages are worth reiterating. Solar is:

- Renewable, low-carbon impact power source that’s well known as “green tech”

- A perpetual energy source, since solar energy will last forever while the world’s oil reserves may last only 30 to 40 more years.

- Totally lacking in moving parts, making for minimal maintenance costs and scheduling

- Noiseless (for areas where noise pollution is a factor)

- A high return investment over the long term thanks to the amount of free energy a solar power plant can produce after commissioning.

So how is solar faring during these very difficult times?

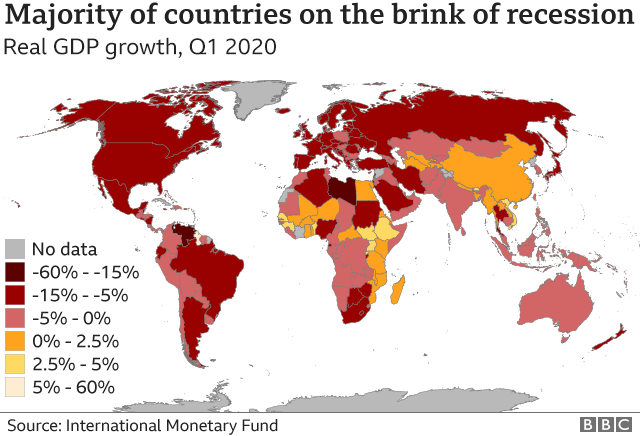

In its June 2020 Global Economic Prospects report, the World Bank suggests the global economy will shrink 5.2% this year. That marks the worst contraction since the 1930s Great Depression.

And according to this chart created by the International Monetary Fund, few countries will be unaffected:

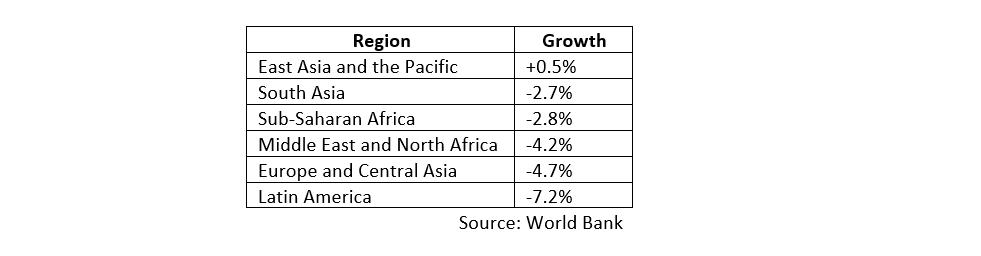

The World Bank provides a regional breakdown:

Deloitte reports that infrastructure financing is being scaled back and project closings are being delayed even as assets are devalued.

In fact, the global economy was already facing a $15 trillion infrastructure gap for 2016 – 2040 according to the Global Infrastructure Hub. (This number can only be much worse today thanks to port closures, travel restrictions and manufacturing shutdowns which have restricted supply chains.)

As just one example, S&P Global reports that $8.84 billion in global mining revenue is at risk and there have been disruptions to 275 mine sites in 36 countries.

Yet from crisis springs opportunity, especially for a trend as powerful as solar power generation.

The Pre-COVID Outlook For Solar Power

Before the pandemic struck, the industry consensus was that solar power was projected to grow faster than both natural gas and coal in 2020.

The U.S. Energy Information Administration (EIA) predicted that solar (and wind) would combine for 75% of new grid capacity. The agency forecast that U.S.-based solar and wind would hit a record 34 gigawatts to surpass the previous highs in 2012 and 2016.

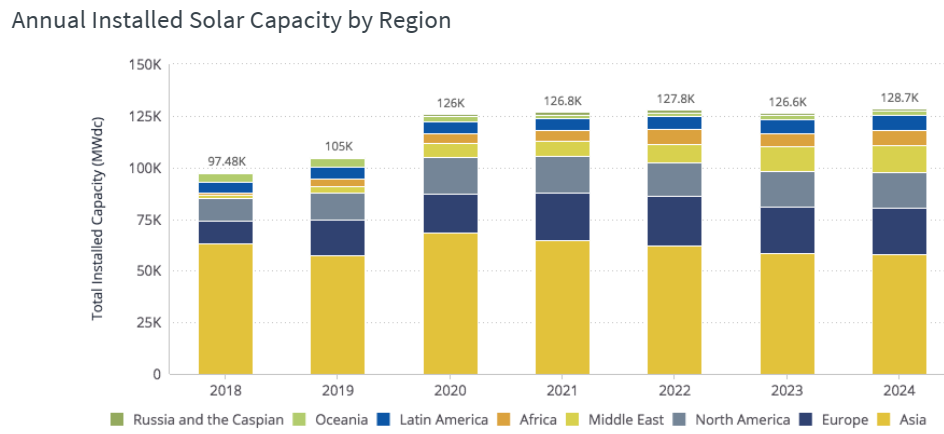

Meanwhile Wood Mackenzie Power & Renewables (WoodMac) predicted that global solar PV installations would exceed 100 gigawatts in 2019 and would grow more than 20% through to 2024.

WoodMac published this bar graph prior to the crisis:

CohnReznick Capital highlighted growing institutional investment interests in renewables. They forecast commercial & industrial solar projects accelerating in 2019 and strengthening further in 2020.

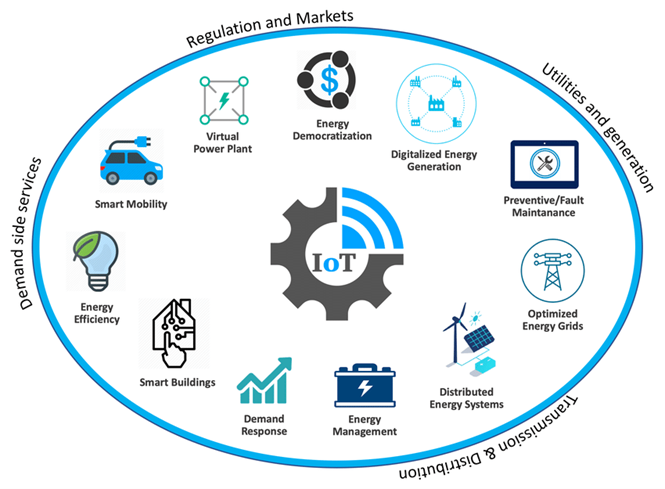

Deloitte concurred, noting that “solar power and other exponential technologies were already penetrating the traditional electric value chain and driving change throughout that value chain.”

The International Renewable Energy Agency (IRENA) found that 83% of global utility-scale solar projects set to be commissioned in 2020 offered lower prices than the cheapest fossil fuel alternatives.

The reasons for all these rosy pre-COVID-19 forecasts were simple:

- Declining costs and rising capacity factors for renewable energy sources

- Increased battery storage competitiveness

- Fossil fuels coming under increasing pressure from climate activism and divestment campaigns.

In summary, lower costs, more favorable regulations and better public relations promised a sunny future for the growing solar power industry.

Then COVID-19 struck. What changed?

How The Pandemic Hit Solar Projects

It should be noted that historically, the solar industry is all too familiar with disruption in the form of trade wars, policy changes, and regulatory uncertainty.

However, the coronavirus economic shutdown has been unprecedented.

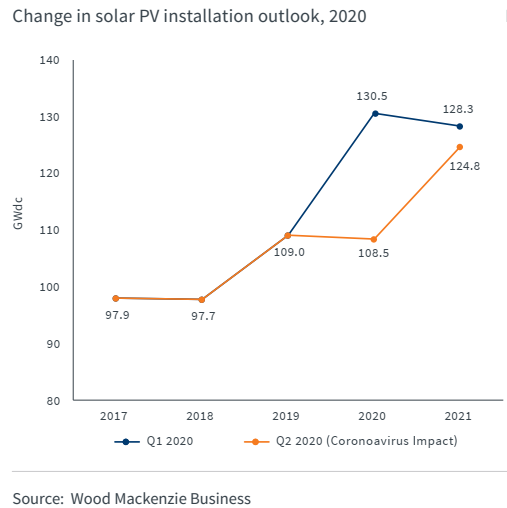

WoodMac now believes that global solar PV installations in 2020 will decline from nearly 130 gigawatts to just over 106 gigawatts, an 18% drop. U.S. solar installations will fall at a similar rate to just 16 gigawatts. All this is due to “project delays caused by supply chain disruptions and the rapid onset of an economic recession.”

This impact is shown in WoodMac’s chart below:

Tax credit timing and supply chain disruptions remain lingering problems, with smaller developers particularly affected by job losses, project delays & cancellations and financing uncertainty. Large developers have felt less impact but delayed site visits, inspections, and permitting will continue to be factors.

The end result is that COVID-19's economic impacts will drastically reduce free cash flow and tax capacity while forcing capital expenditure reallocations to meet core business needs.

While not an ideal situation, solar maintains a better position than it might first appear.

The Future of Solar

That’s because the key drivers underlying solar’s pre-COVID-19 popularity remain in place.

Globally, IRENA has found that “renewable energy could power an economic recovery from Covid-19 by spurring global GDP gains of almost $100tn (£80tn) between now and 2050”.

SolarPower Europe’s newest Global Market Outlook reports annual solar demand should increase by 34% to 150 GW in 2021 and then 12% to 168 GW in 2022 with further incremental increases through to 2024. (This report took the ongoing coronavirus slowdown into account.)

The Confederation of British Industry has calculated that “the so-called ‘choice’ between going green or going for growth was a false one because green business was already on track to become a major pillar of Britain’s future growth.”

South Korea just announced a $95 billion Green New Deal to create 1.9 million jobs through 2025.

In India, the “cost of adding solar electricity is now about 2.5 rupees per unit generated, compared with around 4.5 rupees for new coal capacity.”

And the South African government’s latest Covid-19 Supplementary Budget Speech recognizes that “South Africa doesn’t have the luxury of holding fast to old solutions as the answer.” Their Integrated Resource Plan 2019 (IRP 2019) represents a significant opportunity for the country to diversify its coal-dependent energy mix in favor of green energy solutions like solar power and wind farms.

Governments around the world have made these announcements because voters haven’t stopped insisting on ambitious sustainability goals.

There will likely be an additional post-COVID solar power stimulus: governments are faced with unprecedented unemployment levels. To remain in power, they need to get people back to work. This means “shovel-ready” infrastructure projects are likely to be pushed aggressively in the months and years to come.

Renewables – solar in particular -- have a distinct “shovel ready” advantage:

- A 2017 study found that 7.5 jobs were created for every million dollars invested in renewable energy, compared to 2.7 jobs for the same amount invested in fossil fuel projects.

- A similar study on budget and time overruns found that solar projects had the least amount of delays and that solar and wind projects had the lowest cost overruns.

- Solar and wind projects were found to deliver electricity to grids two to three times faster than fossil fuel projects.

This means solar projects are in pole position for helping governments “where it hurts” with ventures that create plenty of jobs, deliver fast results, and avoid cost overruns.

As Forbes says, such “projects are particularly well suited to providing the kind of ‘shovel ready,’ rapidly deployable projects, with strong employment benefits, that should be appealing to governments crafting stimulus and recovery plans.”

What’s more, companies still face with the same challenges as before the pandemic: the need for energy independence and cost certainty, reduced operational costs, and greater environmental friendliness.

The main takeaway is that there are plenty of reasons to pursue solar projects more aggressively than ever. The long-term trend toward additional solar power generation remains intact.

How Solar Projects Can Address COVID-19 Challenges

All this positive solar momentum is not without challenges, of course.

The construction industry’s complex interconnectedness across countries and continents means schedules, budgets, workforces and supply chains are currently in disarray. This creates uncertainty, which in turn stalls progress, pushes back start dates, and even questions longer-term economic repercussions.

If your firm is currently involved with a solar project or contemplating investing in one, that means assessing that project’s specific or potential problems.

Questions to ask include:

- If my project is at the procurement stage, has stress-testing been performed on spending commitment flexibility and delivery under social distancing and supply chain challenges?

- If construction has already begun, what scenarios are in place for current or potential construction delays, supply chain failures, cost overruns and revenue projections?

- If the assets are now in production, what are the revenue, cost and cash collection sensitivities and how will these affect liquidity and solvency?

The answers will include short, medium and long-term action plans that maintain effective communications, scenario planning, and decision making. Such plans should feature a robust performance and risk framework that incorporates sufficient fine-tuning and stress-testing.

Are you prepared to seize the advantage offered by the tailwinds boosting solar power projects today?

How ADC Projects Can Help

At ADC Projects, we sell expertise in the energy market to commerce and industry, including both big and small solar power projects. We provide Project Development, Project Management and Engineering Services to develop and install renewable power solutions.

To learn more about becoming less dependent on utility power, saving time & money and gaining a real advantage over your competition, please email us today.