More and more developers are considering battery storage solutions for their renewable energy projects, yet they remain a costly component.

Bloomberg NEF reports that in 2019, battery prices were $156/kWh. They also forecast that “by 2023, average prices will be close to $100/kWh”.

So although costs are dropping quickly, and battery systems provide vital dispatchability that stand-alone renewables do not, they remain more expensive on a ‘per kWh’ basis than solar and wind.

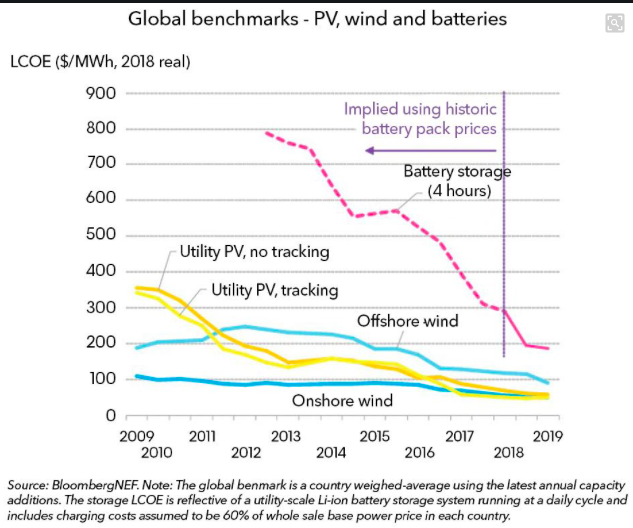

Green Tech Media reports: “Since 2012, the benchmark LCOE of lithium-ion batteries configured to supply four hours of grid power — a standard requirement for many grid services — has fallen by 74 percent, as extrapolated from historical data … In comparison, the LCOE per megawatt-hour for onshore wind, solar PV and offshore wind has fallen by 49 percent, 84 percent and 56 percent, respectively, since 2010.”

This Bloomberg NEF chart shows the LCOE (Levelized Cost of Energy) for two types of wind power and solar power as well as lithium-ion batteries.

(LCOE is the total cost of system ownership (in $) divided by the system production over its lifetime (in MWh))

Despite the narrowing gap, batteries still add significant overall cost to any renewable energy project. How can this extra expense be justified?

The answer is multi-faceted. Battery storage systems generate value by:

- Deferring or eliminating unnecessary investment in future capital-intensive electricity system assets such as wind and solar farms, natural gas power plants, and transmission lines.

- Providing operating and dispatchable reserves to electricity system operators

- Avoiding fuel cost and wear and tear when cycling gas-fired power plants, and

- Shifting energy from low price periods to high value periods (otherwise known as energy price arbitrage)

That last value driver is the focus of today’s article.

What Energy Price Arbitrage Is and How It Works

Energy arbitrage is straightforward to define: you buy electricity at a particular time for a lower price, and then sell it later for a higher price.

The different prices are a result of varying demand over the course of a day and month.

Cheap energy must be stored until it can be sold on for a profit and this means batteries are required to make the arbitrage possible. Systems can charge their battery storage solutions during lower-priced hours and discharge them during higher-priced hours.

The profitability of this energy-charge arbitrage depends on three key factors:

- The price differential between high/low price periods

- The daily and monthly structure of price variability, and

- The duration of high/low price periods

‘Peak’ rates are the most expensive, ‘shoulder’ rates slightly less expensive, and ‘off-peak’ rates are the lowest.

But none of these differentials are possible without a time-of-use (TOU) billing arrangement with the grid electricity supplier, which is exactly what it sounds like. Users are billed at different rates depending on the time of day or month they consume energy.

Meanwhile, Critical Peak Pricing (CPP) refers to times when energy demand is at its highest, regardless of the day of the week or holidays. These are the times when a project owner most wants to be an energy seller and not a buyer.

That’s how energy price arbitrage is supposed to work in theory. How about the reality?

Energy Price Arbitrage Disadvantages

The very first potential problem with arbitrage profitability is the existing or proposed energy rate structure.

A rate structure can be unfavorable if there are insufficient price differentials between high and low points, or if the durations of high vs. low periods are simply not long enough to make the venture worthwhile. Profitable durations may also not occur often enough.

This is a constantly evolving scenario as utilities seek to improve policy and regulations over time.

Other problems relate to technical issues with battery storage systems in general.

For example, not all battery banks are designed to be cycled more than once per day. A given storage solution should be capable of sufficient cycles per day to match any available arbitrage opportunities. This includes fitting it with a suitable energy management system to handle energy flows that maximise profits.

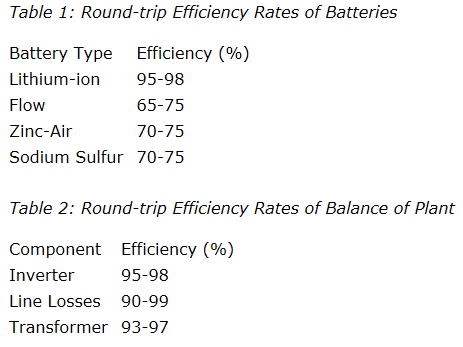

What’s more, energy losses accumulate each time a battery system is cycled. There will always be round-trip efficiency losses along the way.

Energy Storage Consultants reports the following efficiency ranges after polling vendors and drawing upon their own hands-on experience:

Each efficiency loss reduces arbitrage profitability even if the rate structure is highly favorable.

It’s also possible that an existing profitable opportunity may be supplanted by better technology.

For example, there’s an ongoing debate about the future of gas peaker plants. These are natural gas turbine plants which add energy to the grid only during CPP (Critical Peak Pricing) events.

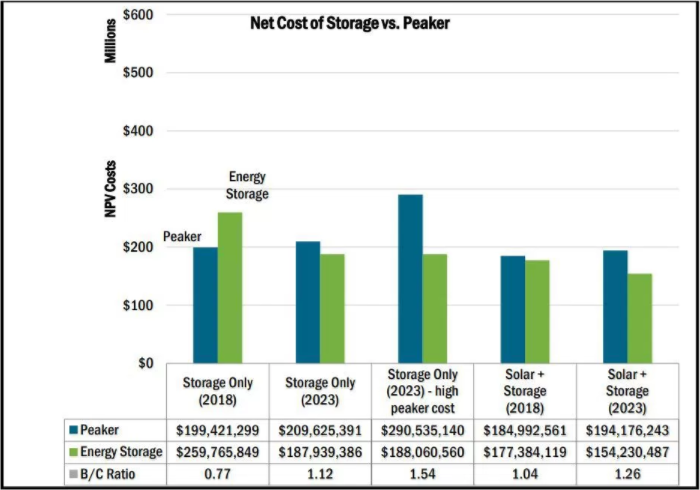

Will peaker plants be replaced by battery storage systems? The sole advantage peaker plants once had over renewables is that they were dispatchable. That advantage is now gone with a battery storage solution which also offers power-on-demand to the grid.

Meanwhile, a study by the University of Minnesota suggests a ‘solar and storage’ combination will soon be cheaper. That suggests a dispatchable renewable solution should take market share from peaker plants in the foreseeable future.

Today’s storage solutions could face the same fate as their own profit-making opportunities are supplanted by better, cheaper batteries.

Advances in battery technology could affect the $/kW and $/kWh price curves (i.e. cost per unit of power and stored energy) and also battery efficiencies and expected lifetimes.

That leads us to …

Questions to Consider About Energy Arbitrage Feasibility

The first area to assess is the market and regulatory environment for a suitable rate structure. What are the local legislation, regulations, and policies like? Do they create arbitrage opportunities wide enough, long enough, and often enough to justify a battery system?

What is the expected annual energy production from a given project? Will there be enough excess to take advantage of what arbitrage is available?

Are there any seasonal, lifecycle, warranty and technology risks that could make the project uneconomic before it pays for itself?

Are there tax incentives that could mitigate any of the negatives?

Does a cost-benefit analysis hold up in light of the above points? How sensitive is this analysis to stress-testing if key parameters don’t meet expectations?

If all the above don’t deliver a satisfactory result, then a project needs to consider what other revenue source can be “stacked” with any existing arbitrage opportunities.

Stacking Other Energy Storage Services with Arbitrage

Most battery projects rely on complex, stacked revenue streams. These might include availability payments, services payments, capacity payments, performance payments, arbitrage, and avoided costs.

It’s possible to secure payments for reducing a supplier’s net demand and network charges, for example. Batteries can also respond during system stress events as capacity providers. Essentially, anything that helps make the grid more stable and resilient while avoiding new infrastructure costs can be a revenue source.

Of course, each revenue stream presents project financing challenges. Dynamic frequency response is typically the most lucrative service, but tends to be offered in limited-duration contracts. Capacity agreements have longer durations but represent considerably less overall revenue.

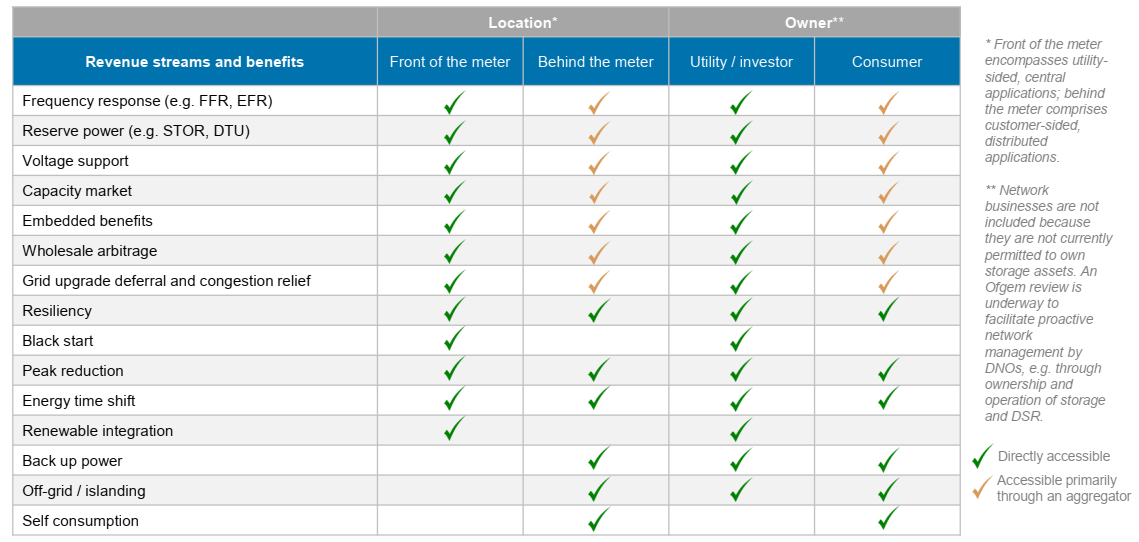

This graphic from Charles River Associates illustrates the range of possibilities available.

Note: The difference between behind-the-meter (BTM) and front-of-meter systems is simply the battery system’s location relative to the utility’s electric meter. A BTM system provides power that can be used on-site without passing through a meter, while a front-of-meter system provides power to off-site locations. BTM systems can provide energy directly to a site without interacting with the electric grid. Any on-site battery storage system is BTM, whereas utility-scale energy storage is typically front of the meter.)

In the end, the ability to stack these different revenue sources depends on both the system’s operating parameters (i.e. how much can it generate, when and at what cost?) plus the rules and requirements for each market or service contract.

Only then can financial returns and a suitable capital structure be determined. Besides the standard NPV and IRR calculations, a full evaluation of revenue and operational performance scenarios is needed. For example, will there be daily or seasonal fluctuations? If so, have those cash flow variations been modelled?

Consideration also needs to be given to relevant bidding strategies (how will the project actually participate in a given market?), competitor analysis, and hedging strategies.

The purpose here is not to discourage prospective developers and financiers from considering battery storage systems for their projects. Quite the contrary!

- Mordor Intelligence reports that “The battery market is expected to grow at a CAGR (compound annual growth rate) of more than 12.31% during the forecast period of 2020 – 2025. Major factors driving the market include declining lithium-ion battery prices, rapid adoption of electric vehicles, growing renewable sector, and increased sale of consumer electronics.”

- Global Market Insights has published a study suggesting the CAGR will be 17.6% from 2020 – 2030.

- Wood Mackenzie Power & Renewable’s comparable report projects “energy storage deployments will grow thirteenfold over the next six years, from a 12 gigawatt-hour market in 2018 to a 158 gigawatt-hour market in 2024 … That equates to $71 billion in investment into storage systems.”

This is clearly a highly desirable market, and our purpose is to ensure developers and investors understand that creating an economically viable battery storage project is not quite as simple as some promoters may have suggested.

While many questions must be asked, those answers are available with a comprehensive and experienced assessment of the available options. In fact, prudence suggests that it’s as necessary to obtain battery-specific rates from a utility as it once was with renewables.

How ADC Projects Can Help

At ADC Projects, we sell expertise in the energy market to commerce and industry, including both big and small hybrid solutions. We provide Project Development, Project Management and Engineering consulting services to develop and install a variety of renewable power projects.

To learn more about becoming less dependent on utility power, saving time & money and gaining a real advantage over your competition, please contact us today